How Inflation Affects Mortgages

Although it’s impossible to predict the housing economy, we can take some cues from what’s been happening and make an educated guess that points to the strong possibility of inflation.

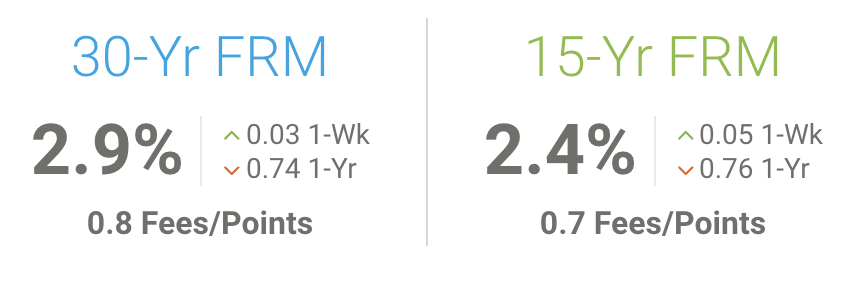

So how does this affect your next home purchase? If you’ve been shopping you will have seen that there is low inventory across the market. Combined with mortgage rates remaining historically low, prices begin to rise. Buyers can afford to pay more because they’re saving so much on the low rates.

But what happens when rates begin to go up as well? With rates on the rise and mortgage payments increasing, your money is stretched to the point where you may need to settle for a less expensive home because the affordability has been affected. Your purchasing power decreases as rates rise,

I’ll ask the question I’ve asked in previous newsletters: What are you waiting for? Even if you thought a few months ago there was a shot that rates might drop even further, you were taking a risk. Now, it seems like waiting might lead you to regretting not striking while the iron was hot.

With the economy moving, unemployment dropping, and vaccines leading us into a hopeful post-pandemic world, there are good things to look forward to, even if we face inflation and a decreasing dollar.

If you’d like to chat about your options, please call me at 617-965-1236. If you’re going to buy this year, we should talk soon.

Ready to buy a new home or refinance the one you own? Please get in touch and I’ll be happy to answer your questions and help guide you through the process. I look forward to speaking with you.

Fenway Safety Guidelines

Tomorrow is Opening Day at Fenway and while fans will be back in the stands for the first time since 2019, Fenway Park will be operating at just 12% capacity to keep within Massachusetts’ COVID safety guidelines.

This means each game you attend will include about 4500 fans seated throughout the park.

There are some safety requirements as well:

- Download the MLB Ballpark app which will include a health screen survey.

- Masks are required for all attendees age 2 and above.

- Tickets are sold in physically distanced “pods” comprised of 2 or 4 seats that allow safe distance between groups.

- Tickets will be delivered via the MLB Ballpark app.

- Fans will be directed to enter the gates closest to their seats, as labeled on their digital ticket on the app.

- All fans must follow the guidelines for proper social distancing while in the ballpark.

*Source: MLB.com

March Home Improver: Washi Tape for Easter Eggs

Tired of dyeing Easter eggs in the same old colors you used when you were a kid? Here’s a new way to decorate eggs while keeping dye and vinegar off your kids’ clothes. It’s fast and fun and it’s called Washi tape.

Washi tape is decorative, textured paper tape. It feels similar to masking tape. You can find it at Target, Michaels, or Amazon. It is based on traditional Japanese Washi paper, which has been around for 1,300 years.

Getting crafty with your Washi tape means you can cut it into patterns and mix-and-match designs to create truly unique Easter eggs. It’s easy for any kid to try. Make a mistake? Just peel it off and apply new tape!

To those celebrating, we wish you a Happy Easter! Thanks for reading this month’s newsletter!

First, let’s look at that saggy door. The culprit is typically a loose screw that may just need to be tightened. But after a few days you may see the door sag again. That’s because the screw has damaged the wood slightly. A quick fix that might solve your problem is to buy a bottle of

First, let’s look at that saggy door. The culprit is typically a loose screw that may just need to be tightened. But after a few days you may see the door sag again. That’s because the screw has damaged the wood slightly. A quick fix that might solve your problem is to buy a bottle of  To reduce odors from rugs and carpets, be sure to sprinkle some baking soda before vacuuming. This will neutralize the odors and leave your room fresher.

To reduce odors from rugs and carpets, be sure to sprinkle some baking soda before vacuuming. This will neutralize the odors and leave your room fresher.

No worries, we’ve got your back with a homemade slime recipe that’s easy and fun. Perfect ghoulish fun for the kiddos.

No worries, we’ve got your back with a homemade slime recipe that’s easy and fun. Perfect ghoulish fun for the kiddos.

As a non-toxic, natural cleaning agent, white vinegar is great for little jobs where either commercial cleaning products don’t exist, or they contain chemicals that may be less eco-friendly or less healthy for a house with small children and pets. Always remember, as with any cleaning agent, do a spot test on fabrics.

As a non-toxic, natural cleaning agent, white vinegar is great for little jobs where either commercial cleaning products don’t exist, or they contain chemicals that may be less eco-friendly or less healthy for a house with small children and pets. Always remember, as with any cleaning agent, do a spot test on fabrics. Not all toilet paper is the same, and those differences could create issues with your septic system. Your best bets are products that are biodegradable, made from recycled paper, and, of course, septic-safe. Here are the brands offering the best results for problem-free flushing. You may be surprised (and relieved) to see some familiar brands.

Not all toilet paper is the same, and those differences could create issues with your septic system. Your best bets are products that are biodegradable, made from recycled paper, and, of course, septic-safe. Here are the brands offering the best results for problem-free flushing. You may be surprised (and relieved) to see some familiar brands. Non-perishable foods. Local food pantries are always in need of non-perishable items. If you have canned goods you’ll probably never use as you clean out the cupboard, you can always donate them to a

Non-perishable foods. Local food pantries are always in need of non-perishable items. If you have canned goods you’ll probably never use as you clean out the cupboard, you can always donate them to a  Dress appropriately. Wear long pants, a long-sleeved shirt, boots or waders and rubber gloves. No exceptions!

Dress appropriately. Wear long pants, a long-sleeved shirt, boots or waders and rubber gloves. No exceptions! Let’s not kid ourselves here. Fresh cranberry sauce is the only choice for foodies with sophisticated palates. It has the consistency of jam and let’s be honest–it’s far more of an actual sauce than the tart, jellied blob that comes a-slidin’ out of the can. When it comes to pure fruit flavor, there is no debate: fresh cranberry wins in a landslide.

Let’s not kid ourselves here. Fresh cranberry sauce is the only choice for foodies with sophisticated palates. It has the consistency of jam and let’s be honest–it’s far more of an actual sauce than the tart, jellied blob that comes a-slidin’ out of the can. When it comes to pure fruit flavor, there is no debate: fresh cranberry wins in a landslide. Pumpkin Stew. It may sound weird, but don’t knock it till you’ve tried it. Pumpkin in stew adds texture and flavor that will make you want to use it for every stew you cook this fall. It’s also delicious (and full of nutrients) in your Chili.

Pumpkin Stew. It may sound weird, but don’t knock it till you’ve tried it. Pumpkin in stew adds texture and flavor that will make you want to use it for every stew you cook this fall. It’s also delicious (and full of nutrients) in your Chili.