Navigating Housing During Hardship and Uncertainty

If you’ve been feeling uneasy (and maybe a little queasy) about making big financial decisions lately, you’re not alone. With ongoing uncertainty in the economy and shifting policies from the new administration, many Americans are thinking twice before locking in major expenses. This is especially true when buying a home.

Tariffs and Rising Home Prices

One major factor causing hesitation in the housing market is the ripple effect of new tariffs, especially those on raw materials. Higher costs for essentials like lumber and steel directly impact new home construction, driving up prices and reducing supply. This means buyers are not only contending with interest rates but also with a market where homes may cost more than expected.

Caution Doesn’t Mean Inaction

It’s important to remember that uncertainty doesn’t mean paralysis. In fact, it’s still a good time to buy, provided you do so safely and wisely. The key? Having the right team around you.

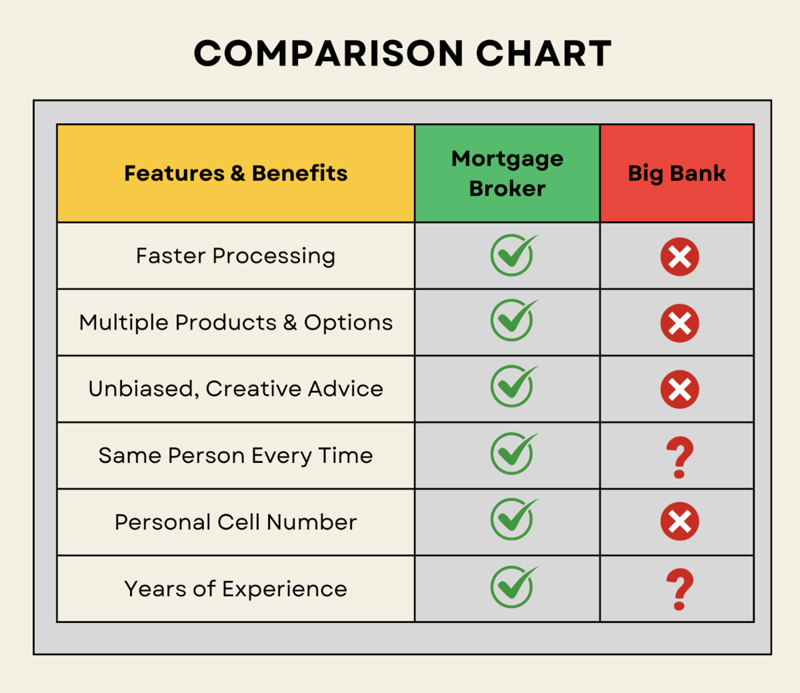

Too often, homebuyers try to go it alone, especially when it comes to shopping mortgage rates. They chase the lowest rate they can find online, without realizing that the best deal on paper may not be the best fit for their actual financial picture.

It’s About More Than the Rate

Your mortgage isn’t just about the rate. It’s about terms, fees, flexibility and how well the loan aligns with your income streams. You have to consider salary, bonuses, commissions, or variable self-employed income.

That’s why working with a qualified mortgage broker like me, along with a trusted real estate agent and an experienced financial advisor is so critical. We help you look beyond the rate and into the full scope of your unique financial reality.

Build a Team That Knows Your Strategy

When your team understands the nuances of your financial picture, they can help you make decisions that won’t keep you up at night — decisions that hold up even in a shaky economy.

Think of it this way: navigating the current housing market is like sailing in unpredictable waters. You need an experienced crew, a good map, and a realistic destination. That doesn’t mean you don’t set sail—it just means you prepare before you get going.

A Smart Move in a Shifting Market

Despite the volatility, the housing market still holds opportunity. Rates are still affordable, and homeownership continues to be one of the best long-term investments you can make. If buying a home is part of your broader financial strategy, don’t let uncertainty scare you off. Just make sure you’re moving forward fully informed with a support system that knows how to steer the ship. (OK, I promise I’m out of sailing metaphors!)

* * * * *

Ready to buy a new home or refinance the one you own? Please get in touch and I’ll be happy to answer your questions and help guide you through the process. I look forward to speaking with you.

Spring Is Finally Here!

And with it comes a sense of renewal, energy and (hopefully) some sunshine between April showers. It’s the season for planting gardens, tackling spring cleaning projects, and cheering on the Red Sox (who are looking pretty good this year for a change).

In this issue, we’re talking about navigating the housing market in uncertain times. While the weather may be warming up, the economy is still throwing a few curveballs.

Our April Home Improver offers a quick guide to growing tomatoes for all you green thumbs (or aspiring ones).

As always, we’re here to help you make smart, informed decisions, whether you’re planting a garden, buying a home, or both.

Let’s make the most of the season ahead!

Home Improver: Getting Started Growing Tomatoes

Tomatoes are a spring/summer favorite for Massachusetts gardeners, but timing and variety are the keys to a successful harvest. Because our last frost typically falls between late April and mid-May, it’s best to start tomato seeds indoors in late March or early April. If you’d rather skip the seed-starting process, buying seedlings or starters from a local nursery in May is a reliable way to go.

Once the danger of frost has passed, usually after Mother’s Day, you can transplant your tomatoes outdoors. Choose a spot with full sun and well-drained soil, and don’t forget to harden off your plants by gradually introducing them to outdoor conditions over 7–10 days.

Once the danger of frost has passed, usually after Mother’s Day, you can transplant your tomatoes outdoors. Choose a spot with full sun and well-drained soil, and don’t forget to harden off your plants by gradually introducing them to outdoor conditions over 7–10 days.

For Massachusetts gardens, some of the best tomato varieties include:

- Early Girl: dependable and quick to mature

- Celebrity: disease-resistant and great for slicing

- Sungold: sweet, orange cherry tomatoes that thrive in short seasons

- Brandywine: pictured above, a classic heirloom with rich flavor (requires more space and time)

Tomatoes love warmth, so wait for soil temps to hit at least 60°F before transplanting. Give them plenty of support with cages or stakes, water consistently at the base, and enjoy fresh, homegrown tomatoes from mid-summer through early fall.

Reduce Humidity: Silverfish love moisture, so use a dehumidifier in damp areas like basements, bathrooms, and laundry rooms. Fix any leaky pipes or faucets to cut off their water supply.

Reduce Humidity: Silverfish love moisture, so use a dehumidifier in damp areas like basements, bathrooms, and laundry rooms. Fix any leaky pipes or faucets to cut off their water supply. Deodorize and Freshen Spaces: Sprinkle baking soda in your fridge, trash cans, or shoes to neutralize odors. Its odor-absorbing power works wonders in keeping spaces smelling fresh without artificial scents.

Deodorize and Freshen Spaces: Sprinkle baking soda in your fridge, trash cans, or shoes to neutralize odors. Its odor-absorbing power works wonders in keeping spaces smelling fresh without artificial scents. What to Look For in Dog-Safe Ice Melt

What to Look For in Dog-Safe Ice Melt Weather Stripping: Apply adhesive weather-stripping tape around door and window frames. This simple solution seals gaps and stops drafts, making your home more energy-efficient.

Weather Stripping: Apply adhesive weather-stripping tape around door and window frames. This simple solution seals gaps and stops drafts, making your home more energy-efficient. Switch to Orange Light Bulbs

Switch to Orange Light Bulbs 1. Install Gutter Guards

1. Install Gutter Guards

Marigolds are typically the go-to for many gardeners. Their strong scent is off-putting to rabbits, and they add a splash of color to any garden. Lavender may give off a soothing aroma to humans, but for rabbits its potency acts as a repellent. Another option is the snapdragon; its bitter taste and tall, thick stalk makes them less appealing to your furry interlopers.

Marigolds are typically the go-to for many gardeners. Their strong scent is off-putting to rabbits, and they add a splash of color to any garden. Lavender may give off a soothing aroma to humans, but for rabbits its potency acts as a repellent. Another option is the snapdragon; its bitter taste and tall, thick stalk makes them less appealing to your furry interlopers.